track record

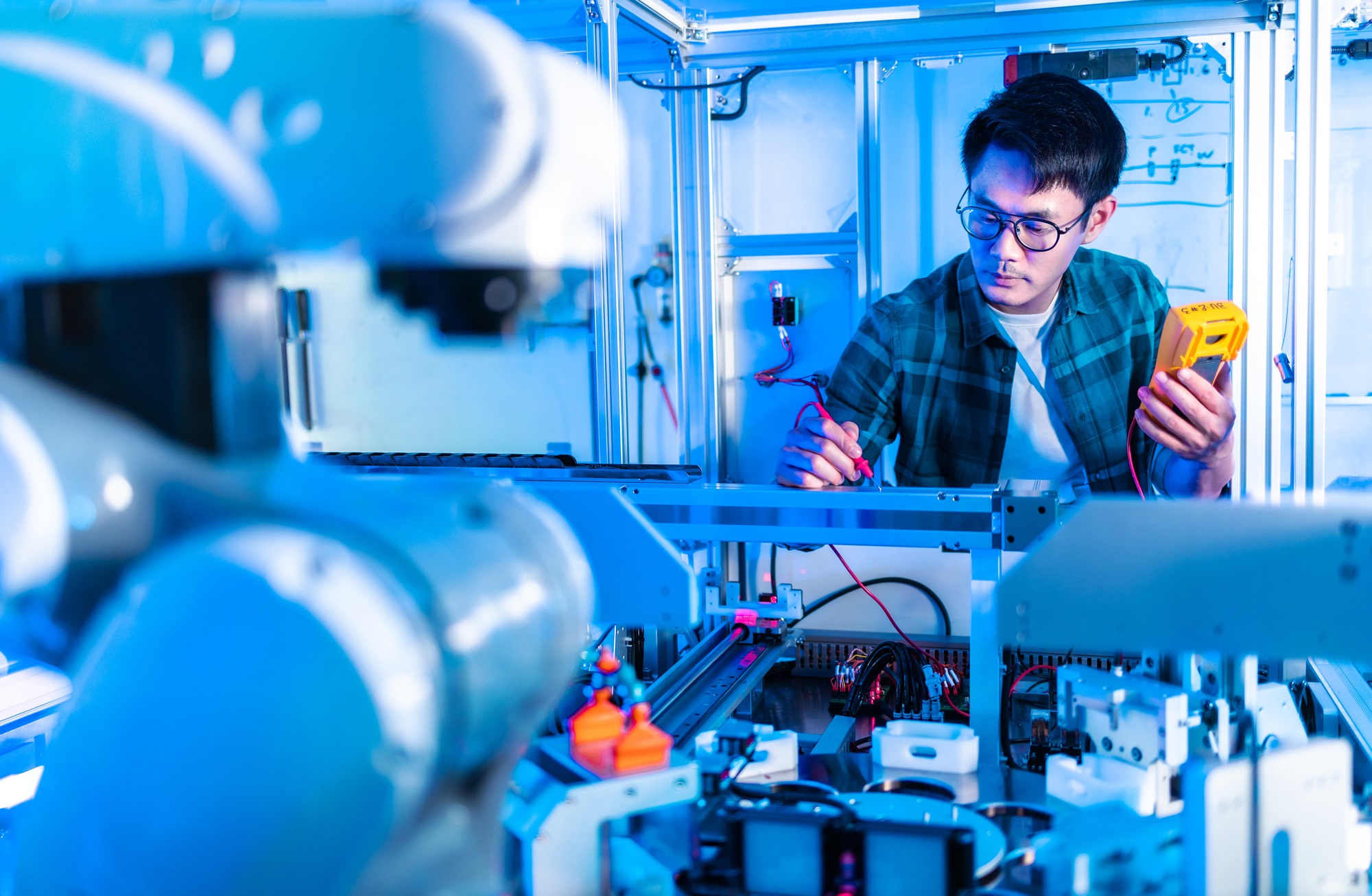

We led the development and commercialization of one of the first products in Italy leveraging machine learning techniques for stock optimization in the pharmaceutical sector.

The project enabled improved forecasting accuracy, reduced inefficiencies in inventory management, and supported integrated decision-making across the supply chain, commercial functions, and executive management.

We designed and implemented AI agent–based solutions to support recurring and complex decision-making processes within pharmaceutical groups and national retail organizations.

The AI agents were integrated into existing decision-making architectures to assist management in evaluating alternatives, managing information flows, and ensuring that decisions align with strategic objectives.

We have guided companies and industrial groups through AI transformation programs targeted at CEOs, executive committees, and boards, focusing on the evolution of leadership and decision-making models.

The activity encompassed the redesign of strategic decision-making processes, the integration of AI into governance systems, and the development of managerial competencies for a conscious and strategic use of artificial intelligence.

We developed and implemented Cognitive Governance models through concrete business cases and operational applications, aimed at enhancing the effectiveness and efficiency of managerial support.

The solutions adopted improved the quality of analyses, reduced information overload, and enhanced management’s ability to focus on high-impact strategic decisions.

We supported various types of clients in submitting third-party interventions before the European Court of Human Rights and amicus curiae briefs before other jurisdictions.

Upon request, we prepared pro veritate legal opinions on a range of issues, including: i) the compatibility of the so-called Domestic Stability Pact with the protection of economic, social and cultural rights; ii) the effects on the Italian legal order of judgments of the European Court of Human Rights finding violations by other member States; iii) the legal implications of nationalisations and unpaid public contracts affecting Italian companies operating in third countries.

We provided legal assistance in drafting design and cooperation agreements for brands operating in the textile sector. The work also included a feasibility assessment regarding the inclusion of standard CSR clauses.

Support activities for a leading credit institution in assessing the compliance of the internal regulatory framework on data governance with the European framework established by the GDPR and the AI Act.

The intervention integrated legal analysis and operational assessment, including the mapping of data processing policies and procedures, the analysis of algorithmic flows, and the verification of consistency with the principles of transparency, proportionality, and accountability. The project enabled the development of a systemic vision of digital risks and strengthened the alignment between regulatory compliance, technological strategy, and internal control architecture.

Advisory services for a leading credit institution aimed at validating and integrating the internal regulatory framework on cybersecurity, with reference to the European sectoral regulatory constellation (NIS2, DORA, GDPR, and AI Act).

The activity focused on the development of a unified digital risk governance model, aimed at integrating technical resilience, organizational oversight, and legal accountability. The work strengthened the coherence between cybersecurity safeguards and corporate control functions, fostering a cross-cutting perspective on digital risk and its systemic impact.

Support to a leading credit institution for the review and integration of corporate guidelines and the internal regulatory framework on AI Governance, in light of the AI Act requirements and European best practices.

The project involved defining the roles and responsibilities of providers and deployers, introducing human oversight procedures, and implementing a continuous audit cycle for algorithmic systems. The approach promoted a holistic perspective of compliance and responsible innovation, aimed at building a trust-based ecosystem between technological governance, fundamental rights, and corporate strategy.

Between 2022 and 2023, we collaborated with the European Commission as Junior Experts, contributing to two reports on e-voting rights and disability rights in the EU.

From 2020 to 2023, we worked as Project Assistants at the European Law Institute (Vienna) for the project Fundamental Constitutional Principles.

We are currently invited members of the Advisory Board of NOVA Pearl (Lisbon), the Scientific Committee of the Centre of AI and Digital Humanism (Luxembourg), and the Centre for Digital Constitutionalism and Policy (Brussels).

We assisted, as Data Protection Officer, an important public institution in fulfilling its data protection obligations (e.g., drafting of data protection policies, data processing agreements, joint controller agreements, records of processing activities, clauses for transborder data flows of personal data), ensuring compliance with the GDPR and national data protection legislation.

We have provided over 15 years of consultancy expertise in governance, risk management, and regulatory compliance for emerging and disruptive technologies, including AI, Quantum Computing, Cloud, and Cybersecurity.

Our work includes advising governments, multilateral organizations, and private sector entities on technology policy, cybersecurity governance, and critical infrastructure resilience. As a member of the G7 Expert Group, we have contributed to regulatory foresight and risk mitigation strategies for AI and Quantum technologies in the financial sector. Additionally, we have supported the World Bank working group in assessing the legal and strategic implications of Quantum Computing in Cloud Infrastructure.

Our expertise extends to dual-use technology transfer and sharp power risks, particularly within Sino-European research collaborations, offering strategic insights to mitigate potential threats.

We have advised on the development and implementation of PPP frameworks to enhance cybersecurity for national critical infrastructure, ensuring a balance between regulatory compliance and technological innovation.

We have led international research initiatives, including serving as Principal Investigator for a U.S. Department of State-funded project focused on dual-use technology risks in global academic collaborations.

We assisted a leading Italian banking and insurance institution in the preparation and update of its Data Protection Impact Assessment (DPIA) within the regulatory framework outlined by the AI Act. The goal was to effectively coordinate the obligations and requirements arising from the intersection of the European Artificial Intelligence regulations and the General Data Protection Regulation (GDPR).

We assisted a leading banking institution in conducting a Fundamental Rights Impact Assessment (FRIA), ensuring compliance with the AI Act and European regulations on the protection of fundamental rights.

The project involved identifying risks associated with the use of artificial intelligence in banking processes, with a particular focus on transparency, non-discrimination, and privacy protection.

Our assistance was completed with the drafting of a policy paper, designed to support the client in the structured implementation of the impact assessment and the management of risk-related aspects.

We supported a global insurance company in addressing a significant revenue loss, attributed to fraudulent activities concentrated in specific areas of Central Europe.

Our intervention involved a detailed data analysis, aimed at identifying the most relevant insights to extract from a large dataset. We then implemented and tested advanced machine learning techniques, leveraging decision tree and random forest algorithms.

A similar approach was adopted for a prestigious international hotel chain, aiming to mitigate revenue losses caused by unexpected and recurring cancellations. By implementing our AI solutions, the chain introduced an innovative intelligent overbooking system, which over time not only significantly reduced but ultimately eliminated the losses recorded in the first months of the year.

Additionally, we developed an advanced customer segmentation system, based on the analysis of available data, to optimize marketing strategies and personalize promotional offers.

We also provided Business Intelligence services to the World Bank, developing an interactive data visualization solution that integrated data from multiple sources. This tool enabled an in-depth analysis of the Human Development Index, allowing for the examination of global human development trends based on 60 years of collected data.

Finally, we developed an automated image recognition system for an e-commerce platform, designed to optimize and accelerate product onboarding procedures in warehouses and enhance search functionalities for items uploaded by third-party sellers. For this solution, we trained a convolutional neural network (CNN)-based model, deploying it on Microsoft Azure to ensure optimal scalability and facilitate future management.

We provided a legal opinion for a digital service provider on the European regulatory framework applicable to data centers, with a particular focus on data governance, environmental compliance, and critical infrastructure management. Special attention was given to the challenges within the European Economic Area (EEA).

The legal opinion provided strategic recommendations for adapting operational models to new regulatory standards and outlined a compliance approach that balances technological innovation with regulatory requirements.

Legal opinions on the following issues: